Payroll overpayment calculator

Part-Time Workers Holiday Calculator Zero-hours contracts Contact. If you are an employee on a monthly salary you are most likely better off using the Monthly Wage Calculator as this includes more detailed features including salary sacrifice company pension deductions and differing tax codes.

Paycheck Calculator Template Download Printable Pdf Templateroller

More Good UK Payroll Calculators.

. 2021 UI Tax Relief fact sheet. The CUMIPMT function requires the. Replacement Lost Check Policy.

Track your mortgage application online. Social Security Benefits. If you find discrepancies make the necessary adjustments.

Decimal time can help prevent this through standardization. IRD numbers Ngā tau. Electing To Apply a 2020 Return Overpayment From a May 17 Payment with Extension Request to 2021 Estimated Taxes-- 12-APR-2021 Other Items You May Find Useful All Revisions for Publication 505.

Your profits worked out as your income minus your expenses. You will need to reclaim the overpayment from their final salary. KiwiSaver for employers Te KiwiSaver mō ngā kaituku mahi.

Use this calculator to estimate. Request a manual payment. Salary Comparison Calculator 202223 compare upto 6 salaries.

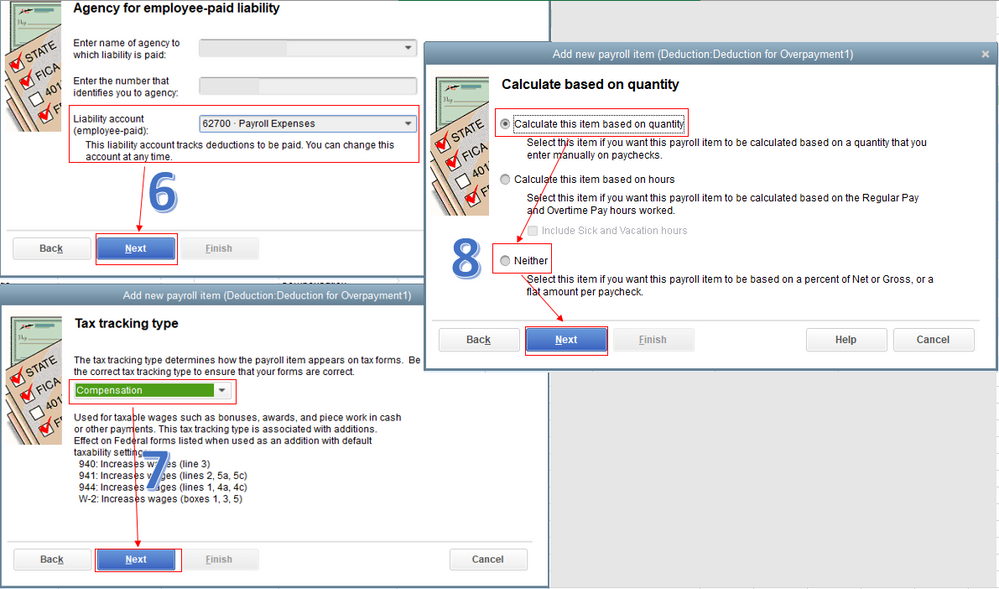

Require an employee to pay money for example an overpayment. For more information view Make a Payment on a Benefit Overpayment YouTube. Find information about the payment of wages in your award by selecting from the list below.

Aug 16 2021 Here are 10 Social Security calculators worth trying. On the other hand if inaccurate calculations lead to overpayment the firm will bear unnecessary expenses. Invest in your future.

My Social Security Retirement CalculatorOnline Benefits CalculatorPlanning for Retirement. Provided the partnership had an open payroll program RP account on March 15 2020 or had a payroll service provider administer its payroll service and certain conditions are met see Q3-8 and meets all other eligibility requirements see Q4 it can make an application for the wage subsidy see Q26. Not to be confused with the federal income tax FICA taxes fund the Social Security and Medicare programs.

If you repaid the overpayment of unemployment benefits in the same year you received them Subtract the amount of unemployment repayment from the total taxable amount you received. The online calculator is provided by Cordell New Zealands leader in building replacement cost calculators. This is because under the new system many wont fully repay before the debts wiped after 30 years use the Student Finance Calculator to see.

Also known as payroll taxes FICA taxes are automatically deducted from your paycheckYour company sends the money along with its. As a rule of thumb if youre a basic-rate taxpayer you should be putting around 30 of your profit aside for tax and national insurance or around 40 if youre paying higher-rate tax use our income tax calculator or check your tax rates. Paycheck Calculator PDF Non-overnight Meals Reimbursement Form.

GST Due Dates. Next compare your 941s to your W-2 forms and confirm that the respective data matches. An integrated payroll system automates payroll workflows helping you avoid manual entry paper-intensive processes that can often open the door to errors.

Business and organisations Ngā pakihi me ngā whakahaere. Request a manual payment if you did not receive your pay or received a reduced pay on your agencies scheduled pay day. Closed Bank Account - Reissue Paycheck Form.

Most of the time this isnt allowed - for example cashback schemes. Overpaying each month could actually be worthless as the overpayments not reducing the amount youd need to pay back at all. General Oregon payroll tax rate information.

Visit Benefit Overpayments to make a payment. If you didnt repay overpayment of unemployment benefits in the same year Include the benefits in income for the year they. Paying two-monthly is the most popular method in New Zealand.

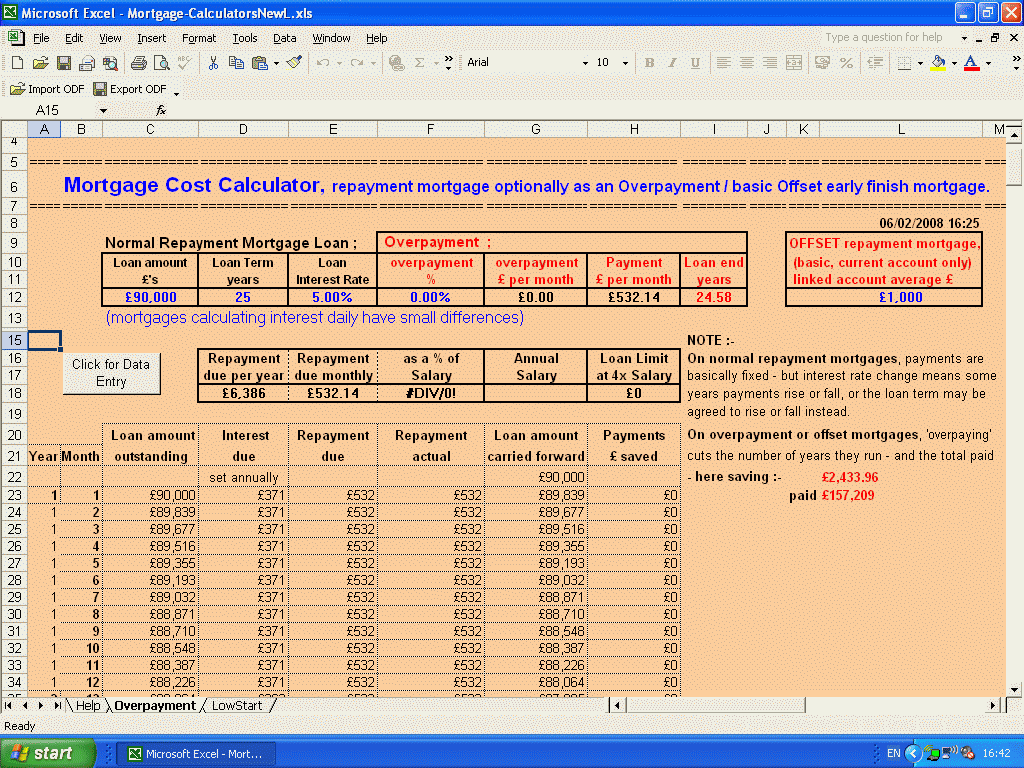

Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments. Queensland government processes and support for employee overpayments. Lost Check - Reissue Paycheck Form.

If you earn a wage or a salary youre likely subject to Federal Insurance Contributions Act taxes. Queensland Shared Services QSS payroll calendar and cut-off times. COVID-19 Interest and Penalty Relief Application.

Cordell has a wealth of experience in overseas markets and brings its technology to New Zealand which is free to use. Similarly to reconciling quarterly payroll look at the annual payroll amounts in your payroll register and compare that with the numbers you reported in all four 941s one for each quarter. Apr 17 2017 In our previous example Jim can collect 750 per month if he claims at age 62 1000 per month if he claims at 66 his full retirement age or 1320 per.

Other financial providers - Investments Pensions Insurance providers. The Benefit Overpayment Statement of Amount Due DE 8301R form is a billing notice that is mailed to you each month. UI Trust Fund and Payroll Taxes FAQ.

Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator. For example if work time is inaccurately calculated during payroll and the total pay is a lower amount of compensation hourly employees can take legal action against the business. Ask Moorepay for expert advice on all things payroll and HR.

For Excel 2003. Income tax Tāke moni whiwhi mō ngā pakihi. Pension plan deferred comp short and long term disability plan flexible spending accounts for healthcare and dependent.

In addition an integrated system keeps payroll activities aligned with time tracking scheduling and employee benefits elections so you can. Online Payroll Reporting System. Automate and integrate payroll processes.

Your employer - they need to know to update your contact details but more importantly they need to know for your payroll. You can choose whether to submit and pay GST monthly two-monthly or six-monthly - it depends on your business size and personal situation - see the IRD website for more details. Goods and services tax GST Tāke mō ngā rawa me ngā ratonga Non-profits and charities Ngā umanga kore-huamoni me ngā umanga aroha.

The Mortgage Guarantee Scheme 95 mortgages. UI Trust Fund fact sheet. In response to the COVID pandemic the Oregon Employment Department is hiring hundreds of positions to help people receive their unemployment benefits.

The Cordell Sum Sure Calculator is used by thousands of people every year from all over New Zealand. 2021 Tax Rates and breakdown of changes for Oregon employers. If you have not yet received this notice or have lost it please contact the EDD at 1-877-238-4373.

Contact the UI Tax Division. Call Payroll at 864-656-5580. Employing staff Te tuku mahi ki ngā kaimahi.

Report the difference as unemployment compensation.

Payroll Processing And Analysis

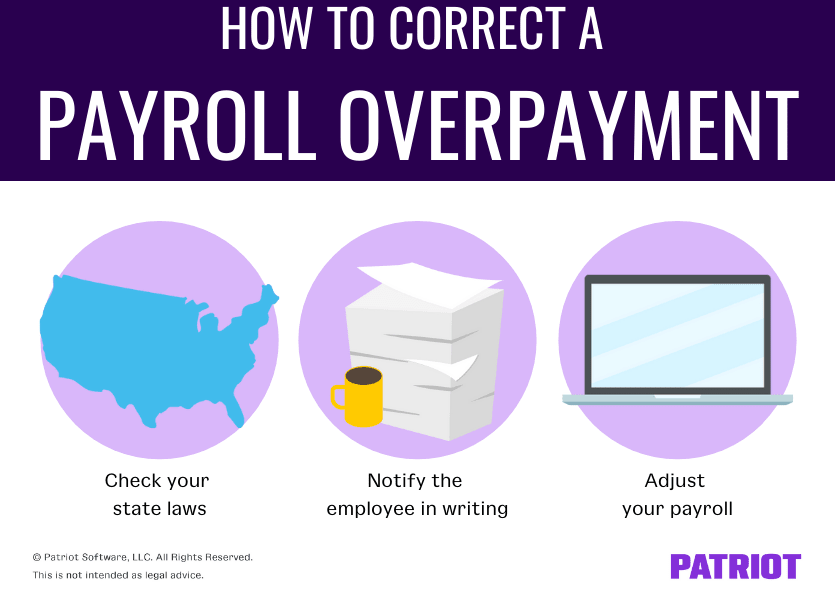

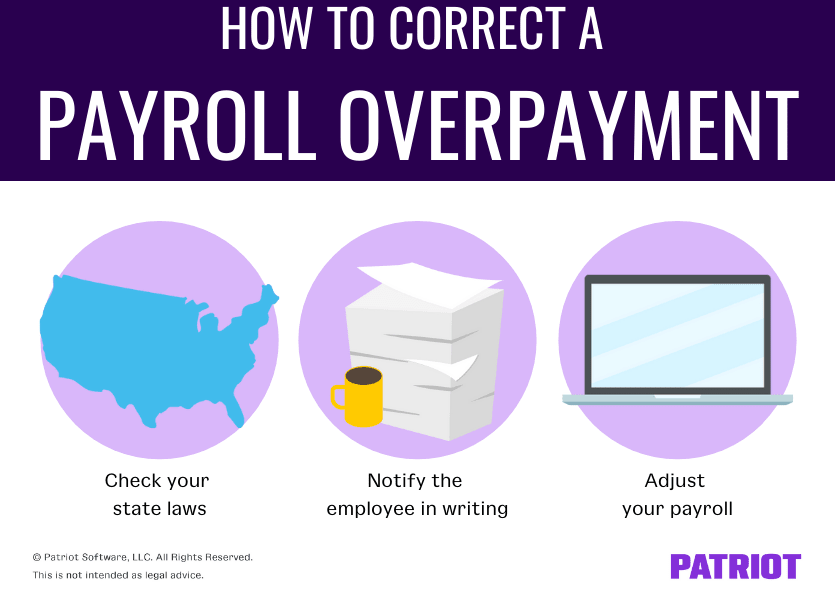

How To Correct A Payroll Overpayment Steps Tax Implications More

Opentaxsolver Payroll Deduction Calculator

Fixing A Payroll Overpayment Or Underpayment Myob Accountright Myob Help Centre

Opentaxsolver Payroll Deduction Calculator

Tools Resources Website Policies And Procedures For Calculating And Submitting Wage Overpayments Ppt Download

Fixing A Payroll Overpayment Or Underpayment Myob Accountright Myob Help Centre

Sap Payroll Overpayment Process Usclm Feng Enterprise

Sap Payroll Overpayment Process Usclm Feng Enterprise

2

Wilmot S Microsoft Office Excel Mortgage Calculators Low Start Deferred Repayment Offset

Sap Payroll Overpayment Process Usclm Feng Enterprise

Special Tax Rate Bijzonder Tarief Payingit International

Employer News Recovering An Overpayment Of Wages

2

Tools Resources Website Policies And Procedures For Calculating And Submitting Wage Overpayments Ppt Download

Solved Manually Override Gross Salary